With the recent and relentless fires tearing up and down California, more and more homeowners are losing access to Homeowners Insurance.

The current climate in the Sunshine State has created a perfect storm for wildfires, and insurance providers are taking huge losses. If you live in a high-risk fire area, odds are you won’t be able to insure your home with a standard insurance provider in the near future. Even worse; most homeowners who already had Homeowners Insurance prior to the fires are having their policies non-renewed at the end of their terms.

This isn’t surprising when looking back at the history of how the industry deals with catastrophic losses. After 9/11, it was slapped with over 32 billion dollars in losses. Because of this, most providers stopped offering coverage for terrorist-related damages altogether. This was short-lived, as legislation was passed in 2002 requiring insurers to provide coverage on the grounds that the losses would be shared between the industry and federal government if they exceeded 200 million dollars. A similar scenario occurred after the events of Hurricane Katrina, as flood coverage exclusions were reinstated by a federal court, protecting the industry from massive future losses.

The contrast between 9/11, Katrina, and the California wildfires is that the federal government has enacted no similar legislation, despite costing the insurance industry over 18 billion dollars from the fires in 2017, and almost 17 billion in 2018. It seems the precedent set by the government in prior crises has not carried over. On top of this, supposed mismanagement of state funds has deterred President Trump from lending a hand financially. He even went as far as to publicly tweet on this, so it is apparent insurers are on their own.

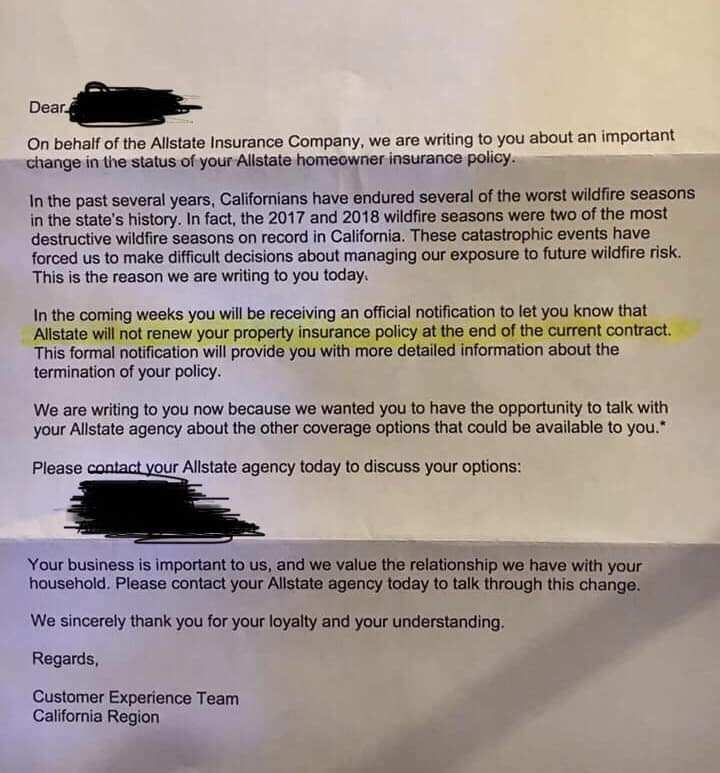

With this being said, there are still alternative options for homeowners desperate to protect their property. Mailed notices, such as the one above, urge customers to contact their provider to see what can be done. This most likely includes a significant rate hike, or writing a new policy with a specialty provider, such as Lloyd’s of London. Statistics show increased rates exceeding far beyond the typical household’s budget, so your best bet may be fire-proofing your property.